Ever feel like you’re spending a ton to get new customers but not seeing enough value in return? That’s exactly what the CAC to LTV ratio helps you figure out. In simple terms, it compares how much you spend to acquire a customer (CAC) against how much that customer is actually worth over their lifetime (LTV).

This metric is a reality check for your marketing and sales investments. If your numbers are off, it might mean you’re pouring money into the wrong channels or targeting the wrong people. Keeping an eye on CAC to LTV can save you from wasted spend and guide smarter growth decisions.

What is CAC to LTV Ratio?

At its core, the CAC to LTV ratio helps businesses determine if their customer acquisition strategy makes sense in the long run. Let’s break down the two components:

Customer Acquisition Cost (CAC) shows how much you spend to get a new customer. To calculate CAC, divide your total marketing and sales costs by the number of new customers acquired over a specific period. For example, if a company spends $2,000,000 on marketing and gains 16,000 new customers, the CAC per customer would be $125.

Lifetime Value (LTV) tells you how much revenue a customer will generate throughout their relationship with your business. There are two common ways to calculate LTV:

- Method 1: Average Revenue Per User (ARPU) × Customer Lifespan

- Method 2: Customer Contribution Margin × Average Customer Lifetime

For example, if a SaaS company has an annual customer contribution margin of $115 and the average customer stays for three years, the LTV would be $345.

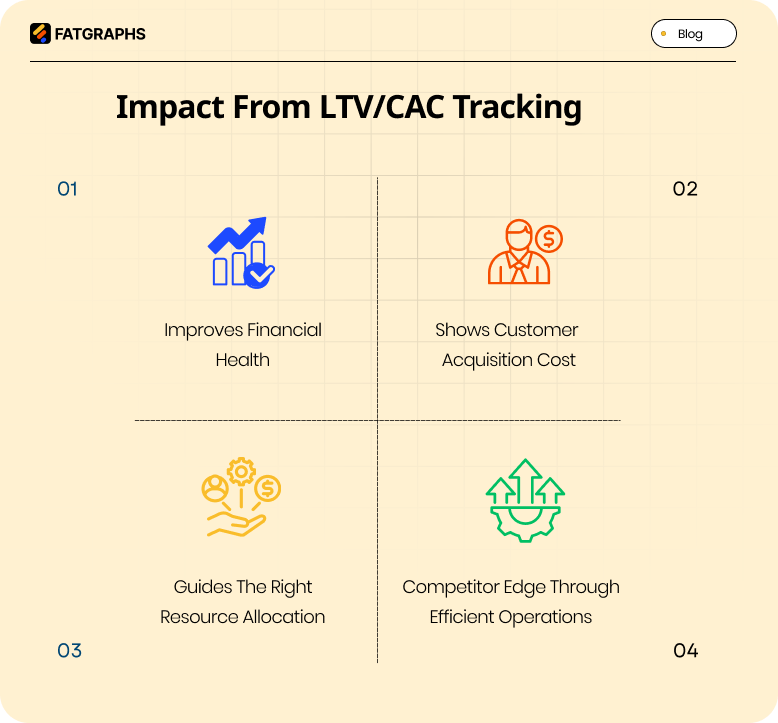

Why this ratio matters for business

Your financial health and business success depend heavily on the LTV/CAC ratio. A good ratio shows that you’re bringing in customers at the right cost and making enough money from them over time.

This number helps you make smart decisions about where to put your resources in customer acquisition, marketing, and product development. On top of that, it gives you an edge over competitors by showing how well your business runs. Investors watch this ratio closely.

As Harvard Business School Professor Christina Wallace notes: “This company has a broad product-market fit and its strong LTV-CAC today is likely sustainable at similar levels over time.”

SOURCE: Harvard Business School

How to Calculate the CAC to LTV Ratio

Calculating this ratio accurately allows you to assess your business’s health and growth potential. Once you understand the formulas for LTV and CAC, you can monitor and improve your strategy effectively.

CAC to LTV ratio formula:

LTV/CAC = LTV ÷ CAC

This division shows how much value you get for every dollar spent acquiring customers.

How to Calculate LTV

| Method 1: | Method 2: |

| LTV = ARPU × Customer Lifespan (Average Revenue Per User) is revenue from a customer over a set period. Customer lifespan is the average duration a customer stays with your business. | LTV = CCM × Customer Lifetime Customer Contribution Margin=Revenue per Customer−Cost to Serve Customer Customer lifetime is the average no. of years a customer continues with a business. |

How to Calculate CAC

CAC = Total Acquisition Costs ÷ Number of New Customers

Include all marketing expenses, sales team salaries, advertising, and promotional costs for a specific period. Divide this by the number of new customers acquired during that time.

Example: A SaaS company has a monthly ARPU of $100, and customers stay for 24 months:

LTV = 100 × 24 = 2,400

If the company spends $600 per customer, CAC = 600

So the ratio is:

LTV/CAC = 2,400 ÷ 600 = 4:1

A 4:1 ratio means the company earns four times what it spends on acquiring customers, a strong return on investment. If your ratio falls below 1:1, you’re losing money, spending more than your customers bring in. Industry experts generally recommend a 3:1 ratio. This suggests you’re covering marketing costs and overhead while still making a profit.

What is a Good CAC to LTV Ratio?

The ideal ratio varies by business model, industry, and growth stage, but there are some general standards:

| Category | CAC : LTV | Notes |

| Healthy | 3:1 or higher | Indicates scalable and sustainable growth |

| Caution | 1:1 – 2:1 | Barely profitable; limited room for growth |

| Problematic | Below 1:1 | Losing money, acquisition costs exceed customer value |

SaaS Benchmarks:

- B2B SaaS: Target 4:1 (average LTV ~$664, CAC ~$273)

- B2C SaaS: Target 2.5:1 (average LTV ~$2,306, CAC ~$166)

SaaS companies often achieve higher ratios because subscription models provide recurring revenue, but they need to manage churn carefully.

Industry-Specific Insights:

| Industry | Average LTV | Average CAC | Typical Ratio |

| Business Consulting | $2,622 | $656 | 4:1 |

| eCommerce | $252 | $84 | 3:1 |

| Entertainment | $823 | $329 | 2.5:1 |

E-commerce usually works with smaller margins and faster customer turnover, while consulting relies on high-value, long-term relationships.

SOURCE: E-commerce CF

A strong CAC to LTV ratio comes from improving customer value and reducing acquisition costs. You can’t ignore either side.

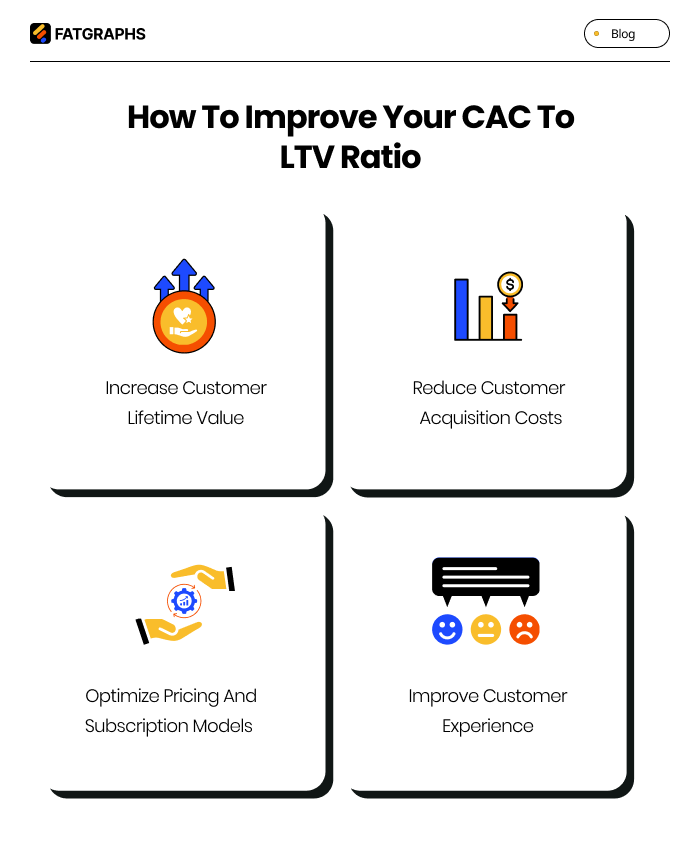

1. Increase Customer Lifetime Value

Retaining customers for longer periods has a significant impact on profits; even a 5% increase in retention can boost profits by 25% to 95%. Encouraging upselling and cross-selling is another strategy. By offering premium features, add-ons, or complementary products to existing customers, you can increase revenue without spending extra on acquisition. The key is to make each customer more valuable over their relationship with your business.

2. Reduce Customer Acquisition Costs

At the same time, it’s important to focus on reducing customer acquisition costs. Target your marketing where your audience actually spends time rather than spreading your budget thin. CRM tools can help your sales team close deals faster and convert more leads, improving efficiency. Customer segmentation is also vital for identifying and prioritizing the groups that bring the most value. You can ensure that your marketing dollars are spent wisely and strategically.

3. Optimize Pricing and Subscription Models

Pricing and subscription models are another powerful lever to improve your CAC to LTV ratio. Offering value-packed tiers, bundled products, or flexible payment plans can make your offerings more appealing and encourage customers to stay longer. A well-structured pricing strategy increases LTV and helps customers see the full value of your products or services, improving retention and long-term profitability.

4. Improve Customer Experience

Delivering an exceptional customer experience can directly impact your ratio. Fast, helpful support keeps customers coming back, while self-service resources and personalized interactions reduce churn. By focusing on creating a seamless and positive experience at every touchpoint, you ensure that customers remain loyal and continue contributing value, strengthening the overall health of your business.

Conclusion

The CAC to LTV ratio is an indicator of long-term business sustainability. It helps you understand whether the money spent on acquiring customers is justified by the value they generate over time. A healthy ratio signals efficient marketing, strong retention, and scalable growth, while a weak ratio highlights the need to optimize acquisition costs, pricing, or customer experience. By monitoring this metric regularly, businesses can make smarter decisions, improve profitability, and grow with confidence.

FAQs

Q1: What is considered a healthy CAC to LTV ratio?

A healthy ratio is generally 3:1 or higher. For B2B SaaS, the target may be 4:1.

Q2: Why is a 3:1 ratio important?

It shows a sustainable business model that covers acquisition costs, operational expenses, and still makes a profit. It also indicates good product-market fit.

Q3: How can a business improve this ratio?

Increase LTV through better retention, upselling, and loyalty programs. Reduce CAC by optimizing marketing channels and the sales process. Improving customer experience and offering value-packed subscriptions also helps.

Q4: Does the ideal ratio vary by industry?

Yes. E-commerce can tolerate lower ratios due to smaller margins, while consulting and high-value B2B sectors aim higher. Benchmarking against your industry helps gauge performance.

Q5: How do investors view the CAC to LTV ratio?

Investors see it as a key indicator of health and scalability. A 3:1 ratio signals strong product-market fit, while higher ratios (4:1 or 5:1) indicate efficient operations and balanced growth.

Book Call with Haroon

Book Call with Haroon